Uncertain Markets: Where Do We Go From Here

By: Dylan Wolf

Fortune Tellers, mediums, and palm readers all share the commonality of attempting to predict the future based on their mystic readings. It seems within the last few months, CRE Principals to Brokers are attempting to replicate that same practice of predicting the future. The widespread message usually lands on the spectrum of pedaling fear of rising interest or the false hope of compressed cap rates. Luckily, this article will shatter the crystal ball.

Q3 Summary and Trends:

To know what will happen towards the end of the year, we must first understand what we can learn from the past year. Year to date, the physical retailer has trended upward, as the national Vacancy rate returned to “normal” levels recorded in 2019. This is due to the influx of 841,000 jobs in July and August which now pushes the employment base over pre-pandemic levels. Additionally, in the first 7 months of the year, the number of stores opened surpassed the number of stores closing by 2X. This is a strong indicator of consumer spending supporting growth. However, with that growth, it does not equate to new development. The single Tenant development over the past year “Ranked as the lowest 12 – month total on record”. This alone has pushed vacancy to 4.5% this past June.

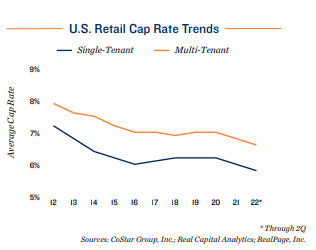

With the early prosperity of the year, also came an increase in investment sales. Across the national market, sales activities rose from 24% to 27%. This was due to the record asking rents and low vacancy rates. There was significantly more competition on property which elevated the sale price to the average mean cap rate of 6% which is a 30 – Point Basis Dip from previous years. With all this momentum going into the year’s second half, how did the velocity come to a train’s stop?

Interest Rates:

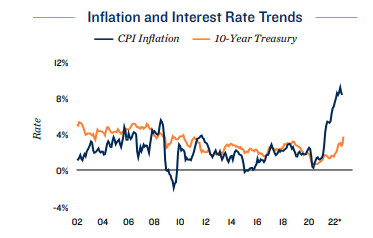

In September, the Consumer Price Index rose by 8.2 Percent. The downshift of spending and increase of interest rates are in part due to the rippling effects of the conflict in Ukraine, “a series of domestic maintenance issues are limiting oil supplies, while the ability to pull from the Strategic Oil Reserve may soon close as stockpiles dwindle”. – Marcus & Millichap Research Services. This has signaled to banks to slow down their lending efforts and, in some instances, shut off some lending altogether such as new construction and bridge loans. As of writing, the Fed has vocalized its efforts to increase the measure to 4 percent before the start of 2023. They will have to increase the rate by 125 basis points to accomplish this. The fed met on November 2nd and increased again at a 75 Basis point hike. They are almost there, which strongly signals their commitment to reaching their goal. What is to say they will continue in Q1 2023?

The Spin:

As stated in the beginning, I am not one to pull a rabbit out of a hat to provide a solution for the future. What I can look at, is the past to provide an answer. Retail will continue to be the go-to for stabilized assets for investors. Long-term leases that have annual percentage increases will be an owner’s savior as it helps hedge against inflation. Like what we saw flourish during Covid, single-tenant retail tenants will be recession-proof. On the other front, what worries me the most, are short-term junior box properties (15,000 – 20,000 SF) that have one to three tenants and short-term leases. These pose high risks for owners, if consumer spending slows, and companies need to reduce space. Large vacancies are costly to fill and will take longer to occupy.

With all that said, deals will still get done. The opportunity for Sellers to carry debt on their properties or have assumable debt will entice some buyers to be more aggressive on pricing. Those who are looking to create more cash flow or leverage this market via a 1031 exchange; If one elects to sell in this market today, they will be still capturing current cap rates while benefiting from the softening of the prices months down the road. Finally, distressed inventory will be enticing for a lot of groups who sat on the sideline during the “seller’s market” over the last year. Like the success stories through the pandemic, the key is to always find opportunity in every market. No one needs their future read to predict that.

For more information or Inventory, please visit: BrownRetailGroup.com

Or connect with me directly: Dylan.Wolf@marcusmilichap.com / 206.826.8761

Sources: Marcus & Millichap Research Services; Bureau of Labor Statistics; CoStar Group, Inc.; Federal Reserve; Real Capital Analytics; RealPage, Inc.; U.S. Census Bureau

About Marcus & Millichap (NYSE: MMI)

With over 2,000 investment sales and financing professionals located throughout the United States and Canada, Marcus & Millichap is a leading specialist in commercial real estate investment sales, financing, research and advisory services. Founded in 1971, the firm closed 9,726 transactions in 2019 with a value of approximately $50 billion. Marcus & Millichap has perfected a powerful system for marketing properties that combines investment specialization, local market expertise, the industry’s most comprehensive research, state-of-the-art technology, and relationships with the largest pool of qualified investors. To learn more, please visit: www.MarcusMillichap.com.